- Ray Dalio is warning of a bubble in stocks as they sit near all-time highs.

- Dalio told Yahoo Finance we’re “kind of like halfway there” to levels of the 1929 and 2000 bubbles.

- He said monetary inflation could hurt stocks if the Fed tries to keep interest rates low.

For legendary investor Ray Dalio, current stock market valuations can largely be traced to two things: high liquidity and low interest rates.

The fiscal and monetary stimulus from the federal government and the Federal Reserve over the last year in response to the COVID-19 crisis are propping up valuations and encouraging investors to drive up share prices as they look for yield.

But a third ingredient – investor behavior – is also contributing to the bubble forming in stocks right now, according to Dalio, who is the founder of Bridgewater Associates, which manages roughly $150 billion in assets.

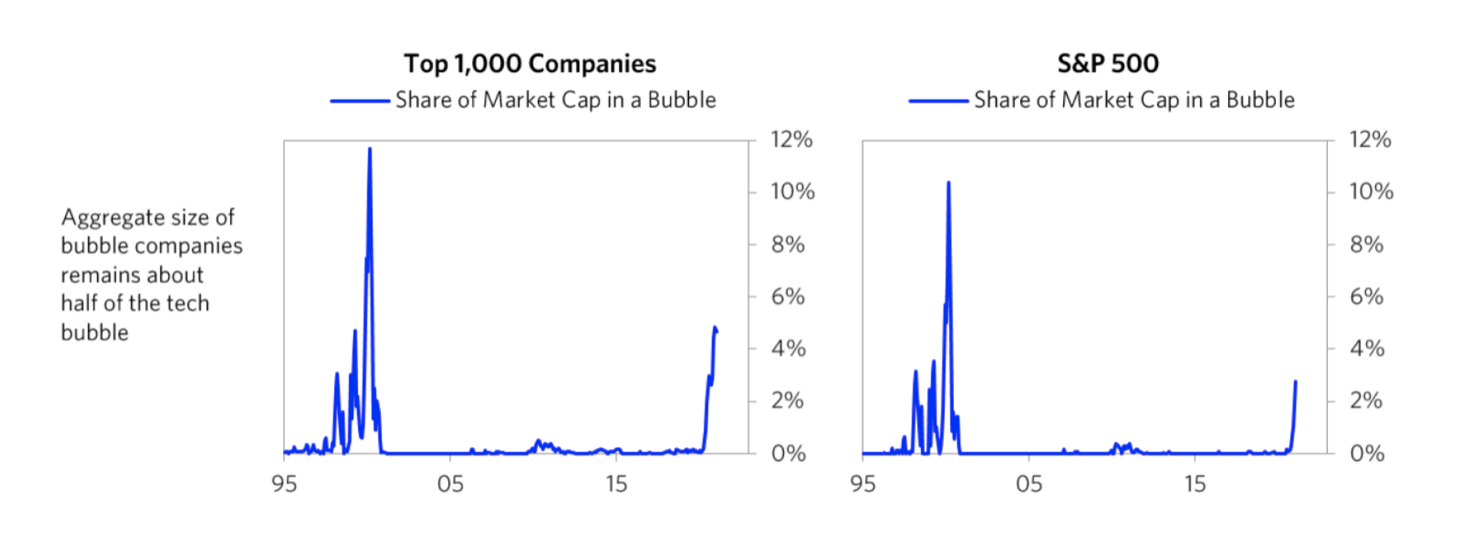

Dalio said in a March 25 interview with Yahoo Finance that investors’ tendency to look backwards is leading to over-extension in the market, particularly in technology stocks, the largest handful of which make up about a fifth of the S&P 500 by market cap.

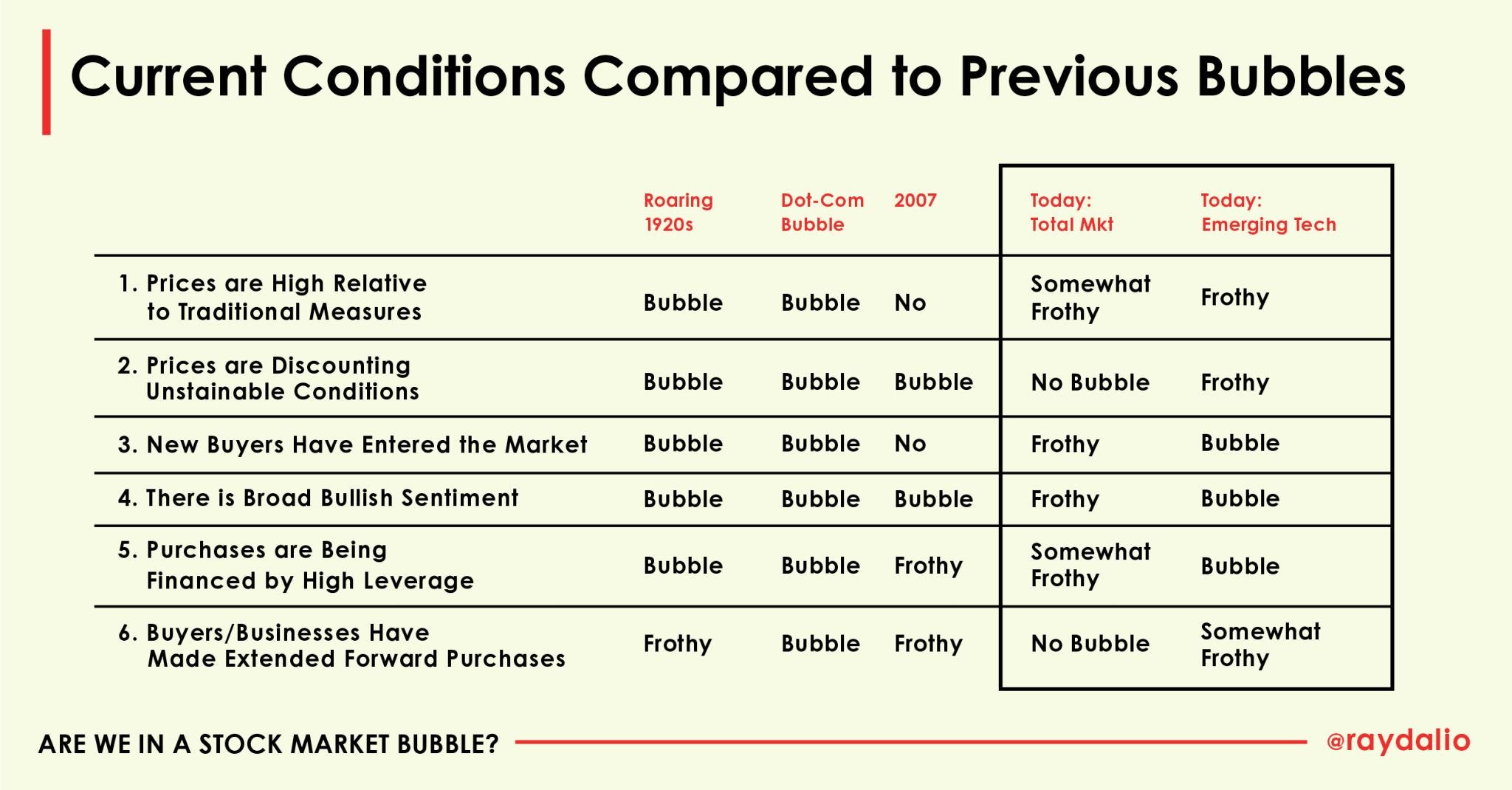

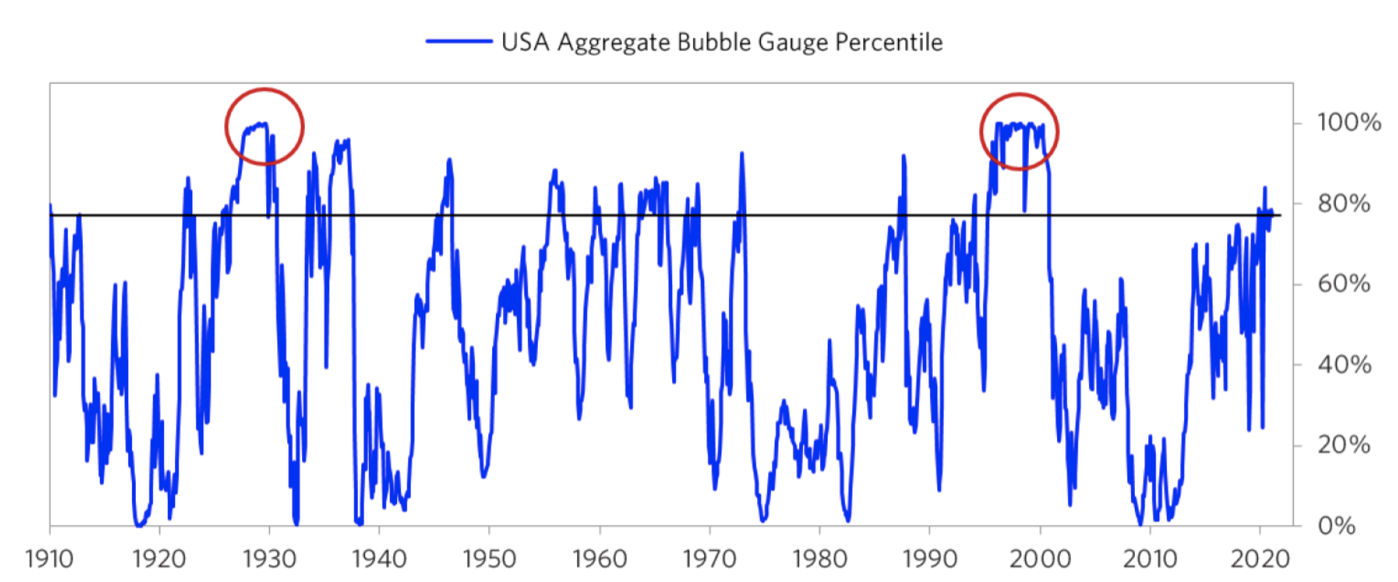

He also said his calculations tell him we're halfway to the levels of some of the historic bubbles of the past, and that investors ought to be wary of weak returns in stocks going forward.

"A lot of new ideas, new technologies, new things come along and they make fabulous revolutions and they grow things and that's great. But there's a tendency of investors to extrapolate the past and not pay too much attention to price. And when that happens, you start to emerge as somewhat of a bubble," Dalio said in the interview.

"By our measures, the bubble is not as what it was in 2000 and not what it was in 1929, but it's kind of like halfway there," he continued. "So what that means from a value point of view if you're calculating, 'what can I realistically expect' ... it's expect a return shrink relative to the others."

Below are three charts that Dalio shared in a February LinkedIn post - which he promoted again on Friday - showing the extent to which he believes we are currently in a bubble compared to prior instances.

As for what might finally burst the bubble, Dalio pointed to the implications of the conundrum facing central bankers as interest rates remain low - which, again, is a contributing factor to soaring stock valuations.

On the one hand, they can raise interest rates, which could send stocks tumbling and throw a speed bump in front of economic growth. But on the other hand, they can keep interest rates low by buying government debt, which would lead to further monetary inflation, he said.

"It's the second that I'm more concerned with. But the supply/demand of debt will be, I think, the big driving influence."

For proof that the Fed's policy is the "biggest dynamic to pay attention to," Dalio pointed to the V-shaped price action in stocks and other financial assets after last year's crisis, thanks to monetary intervention.

It would likely eventually manifest itself in price inflation, hurting the growth stocks that make up such a large percentage of the market's indexes.

Dalio's views in context

Dalio's concerns are certainly not anomalous on the spectrum of market views today. Inflation, driven by what is expected to be a speedy acceleration in economic activity later this year thanks to massive amounts of stimulus, is now the number one fear on Wall Street.

Tech stocks have seen recent volatility as 10-year Treasury yields rise on inflation concerns.

As stocks sit at all-time highs, his views on valuations and future returns, especially when it comes to the mega-cap tech stocks and stock indexes, are being echoed in different corners of the market.

Notorious market bear John Hussman, for one, has been calling for 12 years of negative returns for the S&P 500.

Top strategists at the biggest investment banks, like Morgan Stanley's Mike Wilson and Bank of America's Savita Subramanian, are also cautioning against owning the most expensive names going forward and prefer cheaper, more cyclical sectors.

Still, most remain constructive in their forecasts for the S&P 500's trajectory through this year.

How factors like inflation and valuations behave, and how the Fed will conduct their monetary policy decisions remain to be seen. But as the economy gets set to heat up quickly this summer as vaccinations increase, investors might do well to keep Dalio's speculations in mind.